#1 Best Selling IGNOU Assignments in All Available in Market

Bought By: 1930 Students

Rating:

Get IGNOU MMPF-02 Assignments Soft Copy ready for Download in PDF for (July 2024 - January 2025) in English Language.

Are you looking to download a PDF soft copy of the Solved Assignment MMPF-02 - Capital Investment and Financing Decisions? Then GullyBaba is the right place for you. We have the Assignment available in English language.

This particular Assignment references the syllabus chosen for the subject of Financial Management, for the July 2024 - January 2025 session. The code for the assignment is MMPF-02 and it is often used by students who are enrolled in the MBA (New), PGDIFM, MBAFM Degree.

Once students have paid for the Assignment, they can Instantly Download to their PC, Laptop or Mobile Devices in soft copy as a PDF format. After studying the contents of this Assignment, students will have a better grasp of the subject and will be able to prepare for their upcoming tests.

1. ABC Ltd. has the following book value capital structure as on March, 31, 2024

The equity share of the company sells at Rs. 30. It is expected that the company will pay next year a dividend of Rs. 3 per equity share which is expected to grow at 5% p.a. forever, Assume 40% corporate tax rates.

Based on the above information calculate.

(a) Weighted average cost of capital (WACC) of the company based on the existing capital structure.

(b) Compute the new WACC if the company raises an additional 40 Lakh debt by issuing 13% debentures. This would result in increasing the expected dividend to Rs. 3.60 and leave the growth rate unchanged but the price of the equity share will fall to Rs.24.

2. How are the Cash Flows for Capital Budgeting estimated? Describe the various methods used for evaluating investment proposals.

3. What do you understand by Certainty and Risk? Describe the techniques used for measurement of Project Risk.

4. Explain the following:

(a) Leasing and Hire Purchase. Discuss the difference between these two.

(b) Asset Securitization

5. What is Financial Engineering? Discuss the factors contributing to Financial Engineering.

1. Discuss the distinguishing features of a project and describe the project life cycle.

2. Explain the various techniques used for measurement of project risk.

3. What are the various global sources of financing? Discuss the salient features of depository Receipts Scheme, 2014.

4. What do you understand by Financial Restructuring? How will you assess merger as source of value addition.

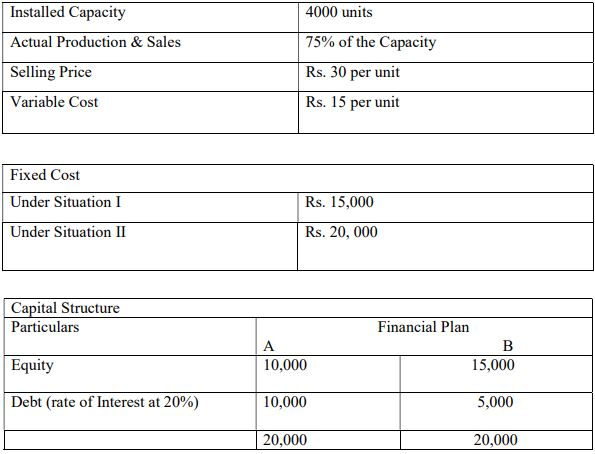

5. Calculate the Operating Leverage, Financial Leverage and Combined Leverage from the following data under situation I and II and Financial Plan A & B.

The IGNOU open learning format requires students to submit study Assignments. Here is the final end date of the submission of this particular assignment according to the university calendar.

Here are the PDF files that you can Download for this Assignment. You can pick the language of your choice and see other relevant information such as the Session, File Size and Format.

In this section you can find other relevant information related to the Assignment you are looking at. It will give you an idea of what to expect when downloading a PDF soft copy from GullyBaba.

In addition to this Assignment, there are also other Assignments related to the MBAFM Financial Management you are preparing for. Here we have listed other Assignments that were bought along with this one.