PLEASE MATCH YOUR ASSIGNMENT QUESTIONS ACCORDING TO YOUR SESSION

IGNOU MS-41 (January 2025 – July 2025) Assignment Questions

1. Select any two firms from the same industry and collect their Financial Statements for the years 2022-2023 & 2023-2024, and calculate their Efficiency, Liquidity and Structural Ratios. Based on these ratios give your views on the working capital management of these firms.

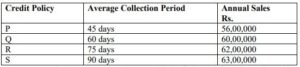

2. The company XYZ Ltd has annual sales of Rs. 50 lakhs and is currently extending 30 days’ credit to the dealers. It is considering change in credit policy and the following information is available:

The average collection period now is 30 days.

Costs: Variable Cost: 80 percent on sales

Fixed Cost: Rs. 6 lakhs per annum

Required (pre-tax) return on investment: 20 percent

You are required to recommend as to which of the policies given above should be adopted by XYZ Ltd. What are the assumptions you have made for coming to such decision?

3. Visit any Bank of your choice and study the methods of Appraisal that the Bank follows while extending Credit Facility to the Business Houses. Write a detail note on your findings.

4. ‘Working Capital Module simulates the integration of working capital components into the Capital Investment (CI) process’. Give the objectives and explanation of the operation of each module that forms a part of the working capital – capital investment process. Also highlight the sequential operation of the WC module.

IGNOU MS-41 (January 2024 – July 2024) Assignment Questions

1. Select any two firms from the same industry and collect their Financial Statements for the years 2022-2023 & 2023-2024, and calculate their Efficiency, Liquidity and Structural Ratios. Based on these ratios give your views on the working capital management of these firms.

2. The company XYZ Ltd has annual sales of Rs. 50 lakhs and is currently extending 30 days’ credit to the dealers. It is considering change in credit policy and the following information is available:

The average collection period now is 30 days.

Costs: Variable Cost: 80 percent on sales

Fixed Cost: Rs. 6 lakhs per annum

Required (pre-tax) return on investment: 20 percent

You are required to recommend as to which of the policies given above should be adopted by XYZ Ltd. What are the assumptions you have made for coming to such decision?

3. Visit any Bank of your choice and study the methods of Appraisal that the Bank follows while extending Credit Facility to the Business Houses. Write a detail note on your findings.

4. ‘Working Capital Module simulates the integration of working capital components into the Capital Investment (CI) process’. Give the objectives and explanation of the operation of each module that forms a part of the working capital – capital investment process. Also highlight the sequential operation of the WC module.